Sports Betting Market Growth, Size, Trends, and Forecast 2025–2033

Market Overview:

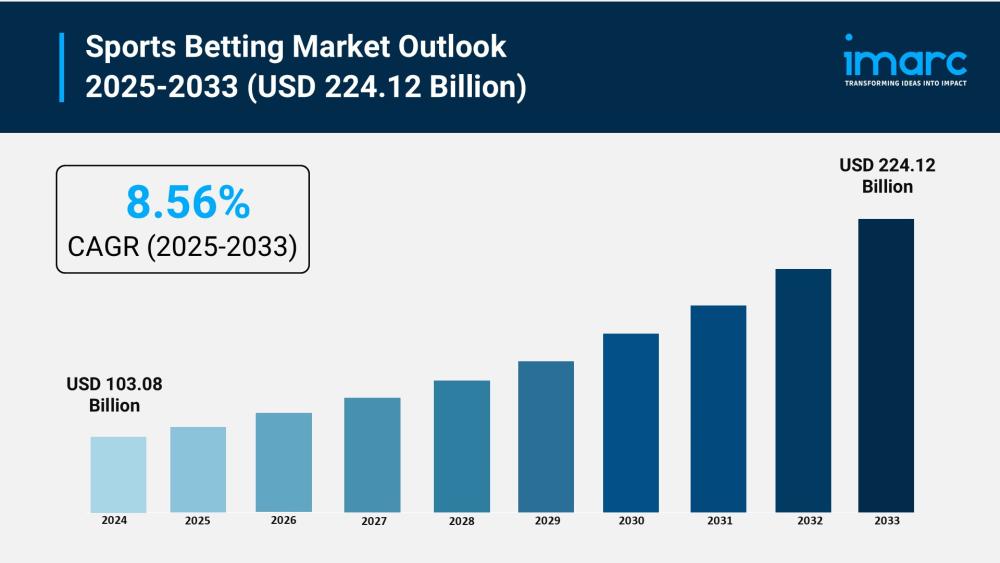

According to IMARC Group's latest research publication, "Sports Betting Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global sports betting market size reached USD 103.08 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 224.12 Billion by 2033, exhibiting a growth rate (CAGR) of 8.56% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Sports Betting Market

- AI-powered prediction models achieve 60% accuracy compared to traditional human analysts' 53-57%, revolutionizing betting strategies with machine learning algorithms that analyze millions of data points in seconds.

- Operators reduce fraud losses by $2.8 billion annually through AI-driven detection systems that identify unusual betting patterns and enhance security, protecting both platforms and bettors.

- Real-time odds adjustments powered by AI achieve 3-7% better accuracy than final market odds (Closing Line Value), enabling sportsbooks to minimize exposure to unexpected results and set more competitive lines.

- Personalized betting experiences drive 35% higher player retention rates as AI analyzes user behavior, preferences, and betting history to offer tailored recommendations and customized promotions.

- GenAI market in sports betting contributes to the projected AI-in-sports market growth from $10.8 billion in 2025 to over $60 billion by 2034, representing a 21% CAGR as platforms adopt sophisticated algorithms for price discovery and liquidity management.

Download a sample PDF of this report: https://www.imarcgroup.com/sports-betting-market/requestsample

Key Trends in the Sports Betting Market

- Mobile and Online Betting Dominance: Online platforms capture 67.5% of the market share, driven by smartphone proliferation with 77% of bettors now preferring mobile apps. BetMGM's 2024 launch in Washington D.C. expanded mobile access, while platforms integrate live streaming and in-play betting features for enhanced user convenience.

- Live/In-Play Betting Surge: Real-time betting transforms viewer engagement, accounting for 28.2% of market share with fixed odds wagering leading. AI enables instant odds adjustments during matches, with OpenBet processing over 140 million bets during UEFA Euro 2024, highlighting the growing demand for interactive, dynamic betting experiences.

- Legalization and Regulatory Evolution: Progressive legalization across 38 U.S. states drives market expansion, with legal betting reaching $121 billion in 2025. The 2018 PASPA repeal sparked widespread adoption, while international markets like Brazil and Ontario see regulatory frameworks creating safer environments and generating substantial tax revenues for governments.

- ESports Betting Expansion: ESports betting gains momentum with titles like League of Legends and Valorant offering year-round opportunities. The rise of competitive gaming attracts younger, tech-savvy audiences, with platforms developing dedicated interfaces and promotions for this rapidly growing segment of digital-native bettors.

- Integration with Sports Media: Partnerships between sportsbooks and leagues, teams, and broadcasters mainstream betting activities. NFL policy normalizes sportsbook advertising in-game, while betting features integrate into live broadcasts and streaming platforms, creating second-screen experiences that boost engagement and normalize wagering as entertainment.

Growth Factors in the Sports Betting Market

- Technological Advancements: Smartphone users expected to reach 6 billion globally by 2027 fuel online platform adoption. Advanced features like real-time odds, AI analytics, live streaming, and blockchain integration enhance security and transparency, attracting 66% of global bettors who maintain or increase their engagement with sophisticated digital betting experiences.

- Global Sports Popularity: Major events like FIFA World Cup, IPL, and UEFA Champions League generate billions in betting activity. Football dominates with 25.4% market share, attracting 2.1 billion euros in FIFA 2018 turnover. Professional leagues and tournaments create countless betting opportunities across basketball, cricket, and other popular global sports.

- Legalization Wave: Regulatory shifts create economic benefits including $8 billion in potential local taxes and $22.4 billion GDP contribution. The U.S. Supreme Court's 2018 PASPA reversal sparked state-by-state legalization, while Europe's mature markets and Asia-Pacific's progressive regulatory changes open new opportunities and ensure safer betting environments.

- Consumer Demand for Entertainment: Over 50% of global bettors cite monetary gain as motivation, but excitement and interactive engagement drive participation. Sports betting transforms passive viewing into emotionally charged experiences, with betting adding entertainment value beyond financial rewards, encouraging both casual and serious bettors to engage regularly.

- Market Competition and Innovation: Operators invest in personalized experiences, innovative betting markets, and promotional campaigns. FanDuel captures 43% of U.S. gross gaming revenue with 14.5% structural hold, while platforms like DraftKings and BetMGM expand through retail presence and digital scalability, driving market competitiveness and user acquisition strategies.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=6028&flag=E

Leading Companies Operating in the Global Sports Betting Industry:

- 888 Holdings PLC

- Bet365 Group Ltd.

- Bet-at-home.com AG (BetClic Everest Group S.A.S.)

- Betfred USA Sports

- Betsson AB

- DraftKings Inc.

- Entain plc

- Flutter Entertainment plc

- International Game Technology PLC

- Kindred Group plc

- Sportech PLC

- TwinSpires (Churchill Downs Incorporated)

Sports Betting Market Report Segmentation:

Breakup By Platform:

- Offline

- Online

Online dominates the market with 67.5% share due to unmatched accessibility and convenience through smartphones and computers.

Breakup By Betting Type:

- Fixed Odds Wagering

- Exchange Betting

- Live/In Play Betting

- Pari-Mutuel

- eSports Betting

- Others

Fixed odds wagering accounts for 28.2% of the market due to its transparency and predictability for both novice and experienced bettors.

Breakup By Sports Type:

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

Football holds 25.4% market share driven by its immense global popularity, extensive fan base, and countless betting opportunities from major leagues and tournaments.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe enjoys the leading position with 41.3% market share owing to high population density, extensive internet penetration, cultural affinity for sports, and progressive regulatory frameworks.

Recent News and Developments in Sports Betting Market

- January 2025: Kambi Group plc revealed a strategic alliance with Stake, broadening its presence in regulated markets. The partnership launched Stake's Kambi-enhanced sportsbook in Brazil, as the nation's updated gambling framework transformed it into one of the globe's most eagerly awaited sports betting markets.

- October 2024: Flutter Entertainment acquired Italian gambling provider Snaitech for $2.6 billion and secured controlling interest in NSX Group, one of Brazil's largest gambling firms, strategically positioning itself in emerging markets ahead of full regulatory implementation.

- September 2024: Sportradar announced plans to revolutionize betting by introducing micro markets, an advanced form of in-play betting products across major sports. The company, alongside Tennis Data Innovations (TDI), launched micro markets for ATP tennis events, creating new revenue opportunities for operators.

- August 2024: International Game Technology PLC expanded in Nevada and Colorado through a technology and services agreement for its IGT PlaySports™ solution at Monarch Casino & Resort, Inc., enhancing retail and mobile sports betting with award-winning platforms and advisory trading services.

- May 2024: BetMGM launched its mobile sports betting app in Ontario, Canada, marking entry into the Canadian market with a strategic partnership with the Toronto Raptors, making BetMGM the team's official sports betting partner.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302